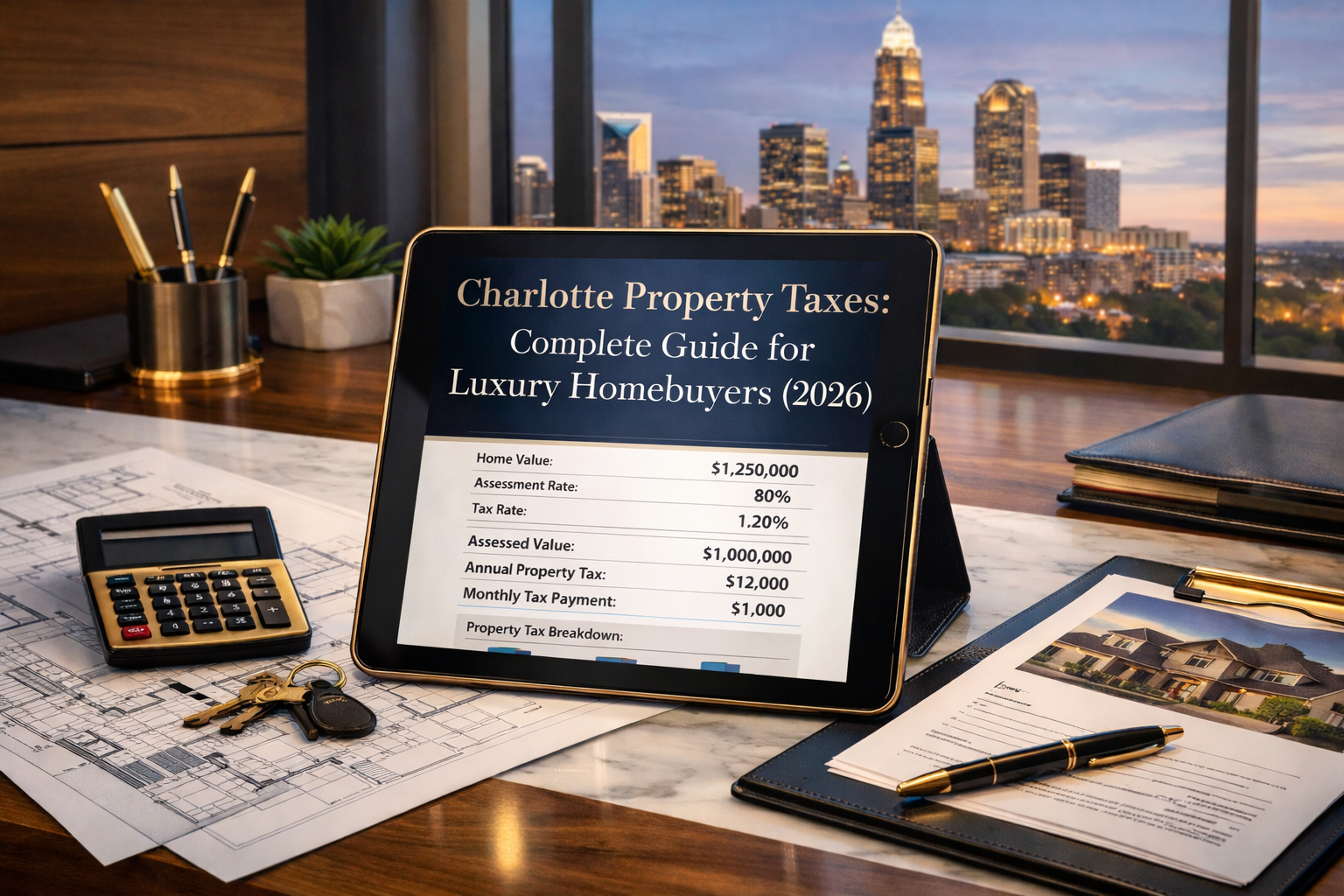

Charlotte Property Taxes: Complete Guide for Luxury Homebuyers (2026)

Property taxes are often the forgotten cost of homeownership, yet they represent one of the largest ongoing expenses for luxury homebuyers.

As a luxury real estate advisor with an MBA, I believe that understanding the total cost of ownership is critical to making a sound financial decision. This guide provides a comprehensive breakdown of Charlotte property taxes for luxury homes, including actual tax bill examples, comparison data, and a step-by-step guide to the appeal process.

THE SHORT ANSWER

The combined property tax rate for Charlotte (Mecklenburg County + City of Charlotte) in 2026 is approximately 1.0339 per $100 of assessed value. For a $1 million home, this equates to an annual property tax bill of around $10,339, or $862 per month. While this is higher than some Sun Belt cities, it's significantly lower than major metros like New York or San Francisco, and North Carolina's lack of a state income tax provides a significant overall tax advantage.

Charlotte Property Tax Rate Breakdown

Your total property tax bill in Charlotte is a combination of several rates. For FY 2026, the primary components are:

- Mecklenburg County Rate: 0.4927 per $100 of assessed value

- City of Charlotte Rate: 0.2741 per $100 of assessed value

- Combined Rate: 1.0339 per $100 of assessed value (plus potential special district fees)

This combined rate is applied to 100% of your property's assessed value, which is determined by the Mecklenburg County Assessor's Office. Unlike some states, North Carolina does not offer a homestead exemption for primary residences.

Not sure how property taxes fit into your budget? As a luxury real estate advisor, I can help you run the numbers and understand the total cost of ownership for any Charlotte property.

Let's connect for a private consultation: Book Your Private Consultation

Actual Tax Bills for Charlotte Luxury Homes

To provide a clear picture of what you can expect to pay, here are the estimated annual and monthly property tax bills for luxury homes in Charlotte based on the 2026 combined rate of 1.0339:

| Home Value | Assessed Value | Annual Property Tax | Monthly Cost |

|---|---|---|---|

| $1,000,000 | $1,000,000 | $10,339 | $862 |

| $1,500,000 | $1,500,000 | $15,509 | $1,292 |

| $2,000,000 | $2,000,000 | $20,678 | $1,723 |

| $2,500,000 | $2,500,000 | $25,848 | $2,154 |

Note: These are estimates and do not include potential special district fees or solid waste fees.

Charlotte vs. Other Cities: Property Tax Comparison

How do Charlotte's property taxes stack up against other major cities? While direct rate comparisons can be misleading due to different assessment methods, here's a general overview of effective property tax rates:

- Charlotte, NC: ~1.03%

- Raleigh, NC: ~1.05%

- Atlanta, GA: ~1.10%

- Nashville, TN: ~0.95%

- Austin, TX: ~1.80%

- Miami, FL: ~1.25%

While Charlotte's rate is higher than some nearby cities, it's important to consider the total tax burden. North Carolina's flat income tax rate of 4.75% is significantly lower than many states, providing a substantial overall tax advantage for high-income earners.

Want to see how your current property taxes compare to Charlotte? I can help you calculate the difference and understand the full financial picture of relocating to a Charlotte luxury home.

KEY INSIGHTS FOR LUXURY HOMEBUYERS

1.Taxes are based on 100% Assessed Value: North Carolina law requires property to be assessed at its full market value, and there is no homestead exemption to reduce the taxable value of your primary residence.

2.Luxury Features Increase Assessed Value: High-end finishes, swimming pools, extensive landscaping, and large acreage will all contribute to a higher assessed value and, consequently, a higher property tax bill.

3.New Construction is Reassessed at Purchase Price: While existing homes are reassessed on a 4-8 year cycle, new construction homes are typically reassessed at their purchase price in the year following construction.

4.Taxes are Paid Semi-Annually: Property tax bills are mailed in July/August and are due on September 1. You can pay in full or in two installments, with the final deadline to pay without interest being January 5 of the following year.

How Property Taxes Are Calculated

The Mecklenburg County Assessor's Office is responsible for valuing all property in the county. The revaluation process, which occurs every 4-8 years, aims to adjust property values to their current market rate. The last revaluation was in 2023, with the next scheduled for 2027.

For luxury homes, appraisers consider factors such as:

- Location and neighborhood desirability

- Square footage and lot size

- Quality of construction and finishes

- Recent sales of comparable properties

- Unique features (waterfront, golf course frontage, etc.)

The Property Tax Appeal Process

If you believe your property's assessed value is significantly higher than its true market value, you have the right to appeal. The process generally follows these steps:

1. Informal Appeal: Contact the Assessor's Office to discuss your assessment with an appraiser. You'll need to provide evidence to support your claim, such as a recent appraisal or sales data for comparable properties.

2.Formal Appeal: If you're not satisfied with the informal review, you can file a formal appeal with the Mecklenburg County Board of Equalization and Review. This is a more structured hearing where you present your case.

3.State-Level Appeal: If the local board upholds the assessment, you can appeal to the North Carolina Property Tax Commission.

Property Tax Deductions for Luxury Homes

The 2017 Tax Cuts and Jobs Act capped the state and local tax (SALT) deduction at $10,000 per household. This includes property taxes, income taxes, and sales taxes. For luxury homeowners in Charlotte, this means that only the first $10,000 of your property tax bill is deductible on your federal income tax return. It's always best to consult with a CPA to understand the specific tax implications for your financial situation.

What's Included in Your Property Tax

Your property tax dollars fund a wide range of essential public services. The largest portion goes to Charlotte-Mecklenburg Schools, followed by county and city services, including:

- Police and fire protection

- Street maintenance and infrastructure

- Public libraries and parks

- Public health and social services

THE FINAL VERDICT

Charlotte's property taxes are a moderate and predictable component of luxury homeownership. While the rate is higher than some surrounding towns, the overall tax burden is competitive with other major US cities, especially when factoring in North Carolina's favorable income tax laws.

By understanding how property taxes are calculated and what they fund, you can make an informed and confident investment in Charlotte luxury real estate.

As a luxury real estate advisor with an MBA, I help buyers understand the total cost of ownership and navigate the financial complexities of purchasing a high-end home. If you're ready to find your perfect Charlotte property, let's connect.

Call or Text: (704) 778-5007

Blog Links:

"Is Myers Park Worth the Premium? (2026 Luxury Home Analysis)"

"Is Eastover the Best Luxury Neighborhood in Charlotte? (2026 Analysis)"

"Is Ballantyne Charlotte Worth It? (2026 Luxury Suburb Guide)"

"Top 5 Luxury Neighborhoods in Charlotte (2026 Buyer's Guide)"

"How Much House Can I Afford in Charlotte? (2026 Luxury Buyer's Calculator)"

Author

Boraski, MBA